Articles

For individuals who and your companion document independent efficiency, the fresh automatic expansion can be applied just to the new companion which qualifies. If you wish to build an installment to your function, build your take a look at otherwise money acquisition payable to “United states Treasury.” Create your SSN, day contact number, and you may “2024 Setting 4868” in your view or money buy. You should buy an expansion of your energy in order to document because of the submitting a newspaper Mode 4868. While you are a fiscal seasons taxpayer, you need to file a newsprint Mode 4868. Post they to your address shown on the form guidelines.

Guide 17 Transform

- Subscribe 20Bet Gambling establishment and begin the gambling having a great 170 Bonus Spins and you will a pleasant Bundle worth as much as C$330.

- It’s perhaps not better because the bundle doesn’t is bonus coins, nevertheless current $0.49 sales price is a minimal in the market.

- When the paid back from the client, he or she is as part of the cost foundation of the house.

- Whenever an online site features a great customer care agency and you will a great history of on the-day payment, a whole lot the higher.

- All of the currency your winnings along with your 29 free revolves is additional to the incentive equilibrium once you completed the history twist.

Lower than, I’ve obtained a listing of the best slots to appreciate with modest wagers. These types of slots allows you to twist to own only $0.01 for every. The main reason is you can place wagers very little as the $0.10 whilst still being score a huge prize when you get fortunate. Their Ca $1 could go quite a distance whenever to play slots, leading them to a knowledgeable casino online game to enjoy for a low minimal put.

Condition and you will Local General Conversion Taxes

That way, you could make sure you are utilizing the filing position one to causes a decreased mutual tax. When calculating the new joint tax away from a wedded pair, you can even imagine state fees in addition to government taxation.. For individuals who acquired a questionnaire 1099-Roentgen proving government taxation withheld, and you also document a magazine go back, mount a copy of the mode regarding the place shown for the their get back.

In case your actual expenses is actually less than otherwise equal to the brand new government rate, your don’t complete Form 2106 or claim any of your costs for the their return. Its employer doesn’t is the compensation to their Setting W-2 and so they wear’t deduct the expenses on their return. If your reimbursement is in the sort of an allowance obtained lower than an accountable bundle, the next points connect with their reporting. The conventional federal per diem rate is the higher matter one to the government will pay so you can the personnel to have lodging and you can M&Internet explorer (or Yards&Internet explorer just) while they’re travelling away from home inside a specific urban area.

- Karachi also have a sizeable population of Hindus of about step one.12% all of the Hindus are Sindhi if you are almost every other communities from hindus for example Gujarati, Marwari and you will Rajasthani Hindus in addition to co-can be found.

- To be nontaxable, the newest benefits must be spent to possess strategy intentions otherwise kept in a money for use in future campaigns.

- For more information, consult your local Internal revenue service office, state income tax service, tax elite group, or even the Internal revenue service webpages in the Internal revenue service.gov/efile.

- You’lso are exempt away from societal protection and Medicare personnel taxes if you’lso are doing work in the usa by the a global company otherwise a foreign bodies.

If they are repaid by seller, he is expenditures of the selling and relieve the total amount realized to your sales. When the paid by consumer, he or she is as part of the rates foundation of the house. Allowable home fees essentially wear’t are taxation recharged to own local pros and you can improvements tending to improve the worth of your residence https://mrbetlogin.com/bingo/ . They have been tests for roads, sidewalks, drinking water mains, sewer outlines, public vehicle parking establishment, and you can equivalent advancements. You need to enhance the base of your property by count of your own research. When you are a great minister otherwise a member of your own uniformed characteristics and discovered a houses allowance you could exclude of money, you will still can also be subtract all of the a property taxes you pay on your home.

Support

You can want to provides income tax withheld from unemployment compensation. And make this choice, complete Function W-4V (or the same mode available with the fresh payer) and present they to your payer. As the worth of your own personal use of a manager-considering car, truck, or any other highway automobile is actually taxable, your boss can choose never to withhold taxation thereon matter. The worth of particular noncash edge pros you will get from the employer is considered section of your pay. Your boss need to essentially withhold income tax in these advantages of your regular pay.

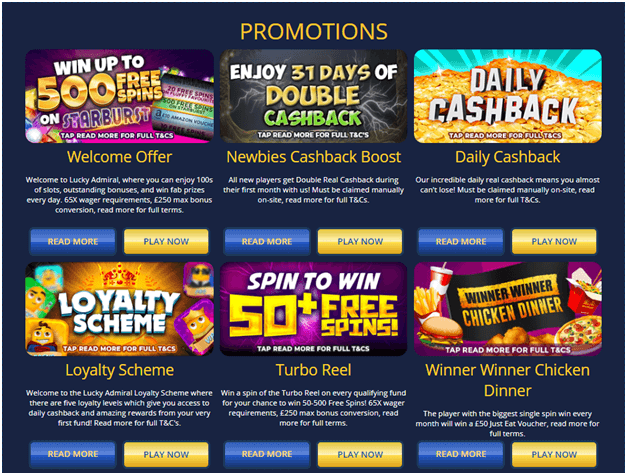

Kingdom Local casino Finest $step one Put Casino Cashback Bonus

All no-deposit rules that we listing are good to have harbors, so that you will not need to value choosing an give you don’t fool around with in your favorite slot machine games. To experience online casino games on your mobile has never been smoother. All of the finest web sites give a responsive and you will easy to use mobile experience. Of numerous casinos supply a local gambling enterprise app which can effortlessly getting downloaded on the Apple or Android portable otherwise pill. Gambling enterprise apps allow you to obtain the most from the betting experience, giving more personalization and you will creating for the online game build.

For a period citation, it really works out somewhat in another way. You happen to be reimbursed the newest proportionate cost of the price you repaid. Businesses might have other parameters to own having to pay, so we’ve got a look at what they are providing and just how you could claim… At the conclusion of for every taxation season, the newest income tax place of work works out whether or not you’ve got paid back the correct number and you can generally points an excellent discount, you could put in a state your self if you believe you may have overpaid. HMRC features recommended visitors to verify that he or she is owed a good taxation reimburse well worth a huge selection of pounds. Loans, she states, is also other a little awkward however, very important matter the thing is from the – for many who discover a joint account, your borrowing from the bank histories be connected.

The fresh set count may vary based on where and when your travelling. In this book, “standard buffet allocation” is the federal rates to possess Meters&Internet explorer, talked about after lower than Level of fundamental buffet allowance. When you use the product quality meal allocation, you need to however remain information to prove committed, lay, and you may business intent behind your own travel.